Keep Your Umbrella Handy

In 2019, the U.S. had a record 11.8 million millionaires, up from 11.5 million in the previous year. An increase in personal wealth may bring greater financial flexibility; it may also bring greater liability. Individuals with high net worth, or those who are perceived to have high net worth, may be more likely to be sued. And personal injury claims can reach into the millions.1

Umbrella liability insurance is designed to put an extra layer of protection between your assets and a potential lawsuit. It provides coverage over and above existing automobile and homeowners insurance limits.

For example, imagine your teenage son borrows your car and gets in an accident, seriously injuring the other driver. The accident results in a lawsuit and a $1 million judgment against you. If your car insurance policy has a liability limit of $500,000, that much should be covered. If you have additional umbrella liability coverage, your policy can be designed to kick in and cover the rest. Without umbrella coverage, you may be responsible for paying out of pocket for the other $500,000, which could mean liquidating assets, losing the equity in your home, or even having your wages garnished.

Umbrella liability insurance is usually sold in increments of $1 million and generally costs just a few hundred dollars a year. It typically covers a broad range of scenarios, including bodily injuries, property damage caused by you or a member of your household, even libel, slander, false arrest, and defamation of character.

Deciding whether liability coverage is right for you may be a question of lifestyle. You might consider buying a policy if you:

- Entertain frequently and serve your guests alcohol

- Operate a business out of your home

- Give interviews that may be published

- Employ uninsured workers on your property

- Drive a lot of miles or have teenage drivers

- Live in a manner that gives the appearance of wealth

- Have a dog, especially if the breed is known to be aggressive

- Own jet skis, a boat, motorcycles, or snowmobiles

Even if you don’t yet have a tent in the millionaire camp, you may want to consider the benefits of liability insurance. You don’t have to be a millionaire to be sued for a million dollars. Anyone who is carefully building a financial portfolio may want to limit their exposure to risk. Umbrella liability can be a fairly inexpensive way to help shelter current assets and future income from the unexpected.

This is a simplified description of coverage. All statements made are subject to the provisions, exclusions, conditions, and limitations of applicable insurance policies. Please refer to actual policy documents for complete details regarding coverage.

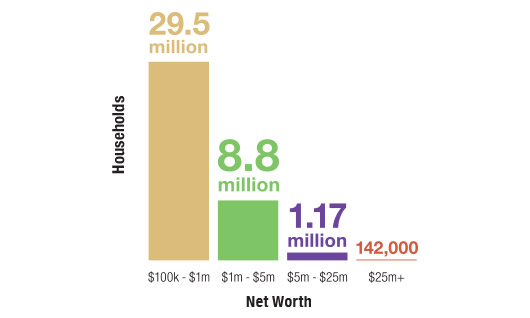

Who's Got What?

In 2018, there were about 31.2 million households in the United States whose net worth was in the $100,000 to $1 million range (excluding primary residence). Only 173,000 households had a net worth of $25 million or more.1

Chart Source: Spectrem Group, 2019

- Spectrem Group, 2019

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2020 FMG Suite.